Dalton Asia Pacific L/S UCITS Fund

- Annual Financial Statements – 2019 pdf 935.1 KB

- Annual Financial Statements – 2021 pdf

- Annual Financial Statements – 2022 pdf

- Annual Financial Statements – 2023 pdf

- ICAV Annual Financial Statement – 2019 pdf

- ICAV Annual Financial Statements – 2020 pdf

- Interim Financial Statements – 2019 pdf

- Prospectus pdf

- Prospectus Addendum pdf

- Semi Annual Financial Statement – 2020 pdf

- Semi Annual Financial Statement – 2021 pdf

- Semi Annual Financial Statement – 2022 pdf

- KIID – A CHF (IE00067LBN24) pdf

- KIID – A EUR (IE00BFXZMC20) pdf

- KIID – A GBP (IE00BFXZMD37) pdf

- KIID – A USD (IE00BFXZMB13) pdf

- KIID – AF EUR (IE000EO5QIY4) pdf

- KIID – B1 EUR (IE00BFXZM553) pdf

- KIID – B1 GBP (IE00BFXZM660) pdf

- KIID – B1 USD (IE00BFXZM447) pdf

- KIID – B2 EUR (IE00BFXZM884) pdf

- KIID – B2 GBP (IE00BFXZM991) pdf

- KIID – B2 USD (IE00BFXZM777) pdf

- KIID – B2 USD (IE00BKDX3X91) pdf

- KIID – E CHF (IE000Z0XYXF1) pdf

- KIID – E EUR (IE00BFXZMG67) pdf

- KIID – E GBP (IE00BFXZMH74) pdf

- KIID – E USD (IE00BFXZMF50) pdf

- KIID – I EUR (IE00BFXZMK04) pdf

- KIID – I GBP (IE00BFXZML11) pdf

- KIID – I USD (IE00BFXZMJ98) pdf

- KIID – P EUR (IE00BFXZMN35) pdf

- KIID – P GBP (IE00BFXZMP58) pdf

- KIID – P USD (IE00BFXZMM28) pdf

Strategy Overview

The Dalton Asia Pacific L/S UCITS Fund’s objective is to seek long-term capital appreciation and to generate absolute returns through a diversified portfolio of long and short positions in equity and equity related securities with a focus on the Asia Pacific region. Dalton Investments (“Dalton”), which manages about $4.4bn in assets (as of 31 March 2024), emphasizes value investments; as such, its’ investment process is based on bottom-up fundamental analysis that follows 3 steps: screening for qualitative traits and historical valuation, in-depth research and onsite visits and final assessment by James Rosenwald, as Portfolio Manager of the Dalton Asia Pacific UCITS Fund. Dalton typically looks to go long deep value opportunities, notably through companies that display strong alignment of interest, and short companies with declining catalysts. Macro‐economic trends are also considered when allocating stocks between countries and sectors. Dalton’s edge also lies in their risk management, concentrating on capital preservation and focused on a longer term investment perspective.

- Long-term investment perspective

- Strive for disciplined, bottom-up, value approach to long and short investing

- Margin of safety and alignment of interests with shareholders sought within investments

- On-the-ground local research teams (12 analysts in total) provide in-depth market analysis and global perspective

- Exposure to companies with market caps in excess of $0.5bn and at least moderate trading volumes

- Portfolio risk managed by employing position limits, adhering to stop‐loss guidelines, and managing gross and net exposures

- Gross exposure: Maximum 200%

- Net exposure: Maximum 80% of which the net long exposure to Japan and Greater China is limited to 70% with the maximum net long exposure to the remainder of the Asia Pacific region limited to 30%

Funds Facts

Legal Structure:

UCITS Sub-Fund of Irish ICAV

Umbrella Fund:

Lafayette UCITS ICAV

Fund Manager:

Dalton Investments INC

Passporting:

Approved in Germany, Italy, U.K., Ireland, France, Switzerland, Luxembourg, Austria, and Singapore

Base Currency:

EUR

Other Currency Share Classes:

USD, GBP, CHF

Liquidity:

Daily

Dealing Deadline (Subscription):

Dealing Deadline (Redemption):

1:00 p.m. Irish time 3 Business Days prior to the relevant Dealing Day

Settlement Date (Subscription):

11:59 p.m. Irish time 3 Business Days following the relevant Dealing Day

Settlement Date (Redemption):

Within 5 Business Days after the relevant Dealing Day

Share B1 | ie00bfxzm553

Performance as of 2024-07-25

NAV

2 487,12 €

YTD

+2,03%

MTD

+0,67%

3 YEARS

+16,25%

LTD

+148,71%

Past performance is not an indicator of future performance.

Informations

Strategy

- Long/Short Equity focused on the Asia Pacific region (including Japan)

General Fund Guidelines

- Value Investments: Dalton approaches investing with long-term disciplined, rigorous, bottom-up value analysis. Dalton searches for stocks based on factors including company’s intrinsic value, “margin of safety” and shareholders’ alignment of interests

- Asia Including Japan: Dalton’s view is that Asia is transforming into one large market. Dalton believes their long-term experience investing in Japan has given them insight on how to identify potential value traps in Asian growth companies

- The long book is diversified across market capitalization, industries, and countries and typically ranges from 30 to 60 positions

- The short book is constructed for alpha generation, shorts not paired with specific long positions and is typically composed of 20 to 40 positions

Instruments & Geography

- Investment universe comprised of equities and equity related securities listed or traded on recognised markets

- Net exposure to Japan and Greater China is expected to be limited to 70% of the NAV with the rest of Asia (including India) limited to 30% of NAV

Philosophy

- Markets are not always efficient: Opportunistically invest when Dalton’s analysis of intrinsic value is mismatched with current market prices

- Invest with a margin of safety: Manage risk based on substantial market dislocations, while using limited borrowing

- Focus on long-term: Focus on long-term performance rather than short-term market fluctuations to provide room for Dalton’s investments to compound at superior rates over time

- Volatility is not risk: Risk defined as the permanent loss of capital. Volatility provides Dalton with the opportunity to deploy capital

- Understand risk tolerance: Capital preservation is the first priority when Dalton believes that their analysis of current market valuations meet their requirements for a large margin of safety and potential significant upside

- Dalton is strongly convinced that companies with superior ESG practices are symbiotic with their investment philosophy. As such, not only have they become a UN-PRI signatory, they have developed a robust ESG practice, allowing to assign an internal rating to every company considered for investment across a large number of aspects that are expected to participate in the improvement of intrinsic value and further support wealth creation for minority shareholders

Key Professionals

James B. Rosenwald

Chief Investment Officer & Portfolio Manager

James B. Rosenwald is Chief Investment Officer and Portfolio Manager. He is a recognized authority in Pacific Rim investing with more than 30 years of investment experience. He formerly co-managed and founded Rosenwald, Roditi & Company, Ltd. (now known as Rovida Asset Management, Ltd.), which he established in 1992 with Nicholas Roditi. Mr. Rosenwald advised numerous Soros Group funds between 1992 and 1998. He commenced his investment career with the Grace Family at their securities firm, Sterling Grace & Co. Mr. Rosenwald holds an MBA from New York University and an AB from Vassar College. He is a CFA charterholder and a director of numerous investment funds. He is a member of the CFA Society of Los Angeles and the CFA Institute and is an Adjunct Professor of Finance at New York University’s Stern Business School.

Shares

Investor profil | Shares | Currency | ISIN | BBG Code | Inception | Mgmt Fee | Perf Fee |

|---|---|---|---|---|---|---|---|

Seeding * | B1 | EUR | IE00BFXZM553 | LDAPB1E ID | 17.07.2013 | 0.75% | 0% |

Institutional Early Bird | B2 | EUR | IE00BFXZM884 | LDAPB2E ID | 30.08.2013 | 1.00% | 10% |

Institutional Early Bird | B2 | USD | IE00BFXZM777 | LDAPB2U ID | 11.08.2020 | 1.00% | 10% |

Institutional Early Bird | B2 | UN USD | IE00BKDX3X91 | LAPUB2U ID | 25.02.2020 | 1.00% | 10% |

Institutional Early Bird | B2 | GBP | IE00BFXZM991 | LDAPB2G ID | – | 1.00% | 10% |

Super Institutional | E | EUR | IE00BFXZMG67 | LDAPUEE ID | 06.09.2022 | 1.25% | 15% |

Super Institutional | E | USD | IE00BFXZMF50 | LDAPUEU ID | – | 1.25% | 15% |

Super Institutional | E | CHF | IE000Z0XYXF1 | LDAPECH ID | – | 1.25% | 15% |

Institutional | I | EUR | IE00BFXZMK04 | LDAPUIE ID | 14.09.2022 | 1.50% | 15% |

Institutional | I | USD | IE00BFXZMJ98 | LDAPUIU ID | – | 1.50% | 15% |

Institutional | I | GBP | IE00BFXZML11 | LDAPUIG ID | – | 1.50% | 15% |

Private Bank | P | EUR | IE00BFXZMN35 | LDAPUPE ID | 28.02.2014 | 1.50% | 15% |

Private Bank | P | USD | IE00BFXZMM28 | LDAPUPU ID | 28.02.2014 | 1.50% | 15% |

Private Bank | P | GBP | IE00BFXZMP58 | LDAPUPG ID | – | 1.50% | 15% |

Allfunds | AF | EUR | IE000EO5QIY4 | LAAPUAP ID | – | 1.50% | 15% |

Retail | A | EUR | IE00BFXZMC20 | LDAPUAE ID | 28.02.2014 | 2.00% | 15% |

Retail | A | USD | IE00BFXZMB13 | LDAPUAU ID | 14.11.2014 | 2.00% | 15% |

Retail | A | CHF | IE00067LBN24 | LDAPACH ID | – | 2.00% | 15% |

Extra-Financial Analysis & SFDR Classification

The Sub-Fund meets the classification of an Article 8 fund as it promotes environmental and social characteristics.

The following sub-fund of Lafayette UCITS ICAV (the ”ICAV”) is classified as an Article 8 financial product under SFDR.

Name: Lafayette UCITS ICAV – Dalton Asia Pacific UCITS Fund (the ”Sub-Fund”)

LEI: 549300TGASUQVO56PQ70

Further disclosures in respect of the Sub-Fund which meets the criteria of an Article 8 financial product under SFDR are contained in the prospectus for the ICAV and the supplement for the Sub-Fund at the following link: https://www.longchamp-am.com/overview/dalton-asia-pacific-l-s-ucits-fund-ie00bfxzm553/

This disclosure is accurate as at 06 December 2023.

Article 10 EU Sustainable Finance Disclosure Regulation (“SFDR”) disclosure – in accordance with Chapter IV, Section 1 of Delegated Regulation 2022 / 1288 (“Level 2 RTS”)

In accordance with Article 10 of the SFDR, and Chapter IV, Section 1 of Delegated Regulation (EU) 2022/1288, this document provides information on the environmental and social characteristics promoted by the Sub-Fund and the methodologies that are used to assess, measure and monitor these characteristics.

Defined terms used in this disclosure (unless defined herein) are as set out in Sub-Fund offering documents. Terms used in the summary have the same meaning as in the rest of this website disclosure.

Summary

The Sub-Fund is categorised as an Article 8 financial product for the purposes of SFDR as it promotes environmental and social characteristics.

When determining what investments to make for the Sub-Fund, as part of the Investment Managers’ Sustainable Investment Policy, the Investment Manager considers environmental and social factors (at industry or company specific level), as detailed below.

Dalton Investments, Inc. (the ”Investment Manager”) applies its own proprietary systems and research, aiming to develop an accurate understanding and assessment of a portfolio company’s ESG practices. While the Investment Manager uses Refinitiv’s Asset4 and MSCI ESG external research data as its principal providers for ESG metrics, the Investment Manager also conducts its own proprietary research to arrive at independent ratings.

No Sustainable Investment Objective

The Sub-Fund promotes environmental or social characteristics but does not have as its objective sustainable investment.

Environmental or social characteristics promoted by the Sub-Fund

When determining what investments to make for the Sub-Fund, as part of the Investment Managers’ Sustainable Investment Policy, the Investment Manager considers the following environmental and social characteristics:

Environmental characteristics: assessing through the Investment Manager’s own due diligence and external third-party data, a company’s policies towards managing emissions, energy usage and waste management.

Social characteristics: a focus that a company has on talent management and retention of employees and policies surrounding health, and safety and working practices.

Investment Strategy

The Sub-Fund seeks to achieve an attractive long-term capital appreciation through a diversified portfolio of long and short positions in equity and equity related securities with a primary focus on the Asia Pacific region. The Investment Manager’s Sustainable Investment Policy consists of a multistage approach to integrating ESG factors and Sustainability Risks in investment decisions. As part of the Investment Manager’s Sustainable Investment Policy, the Investment Manager incorporates ESG factors into an assessment of potential investments for the Sub-Fund. The Investment Manager focuses on governance factors. The particular focus relates to two key elements of the Investment Manager’s investment philosophy, namely (i) investing in businesses where the shareholders’ interests are aligned with the company’s management; and (ii) where the company’s management has a track record of good capital allocation decisions, which have created long term value for all shareholders.

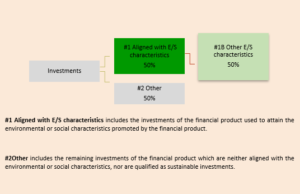

Proportion of Investments

The Sub-Fund aims to hold a minimum of 50% of investments of the Sub-Fund’s portfolio that are aligned with the environmental or social characteristics promoted by the Sub-Fund. The Sub-Fund does not commit to holding sustainable investments.

Monitoring of environmental or social characteristics

The Investment Manager considers a variety of sustainability indicators to measure the environmental and/or social characteristics promoted by the Sub-Fund, including identifying companies that:

- hold ISO 14001 (or equivalent) and/or ISO 50001 (or equivalent) certifications;

- are members of the UN Global Compact and have adopted UN Sustainable Development Goals in their long-term planning;

- are aligned with the Paris Agreement and those that are EU Taxonomy aligned;

- hold OHAS 18001/45001 (or equivalent), ISO 27001 (IT security), and/or ISO 9001 (quality management) certifications; and have publicly documented human rights policies, ethics and corruption policies and sufficient whistleblower protections in place.

Methodologies for environmental or social characteristics

The Investment Manager will assess and track the performance of the above sustainability indicators. The sustainability indicators will be used to measure the attainment of the environmental and social characteristics promoted by the Sub-Fund.

Data sources and processing

The Investment Manager uses a range of data providers when assessing a portfolio company’s ESG practices, in addition to its own proprietary analysis. The primary third party data providers are Refinitiv and MSCI, in addition to Bloomberg.

Limitations to methodologies and data

The Investment Manager recognises the limitations in data sets across Asian markets and external ESG methodologies provided by third party vendors and does not rely on it exclusively. [The Investment Manager is satisfied such limitations do not affect the promotion of environmental or social characteristics.][1]

[1] Maples Comment: To be confirmed by Dalton.

Due Diligence

Prior to making an investment, the Investment Manager will carry out its own due diligence of a company including a company’s ESG policies, in addition to utilising resources such as engagement groups through UN PRI and or Climate Action 100+.

Engagement Policies

The Investment Manger views engagement with investee companies as an essential part of the investment process.

Designated Reference Benchmark

A reference benchmark has not been designated for the purposes of attaining the environmental or social characteristics promoted by the Sub-Fund.

Extended Disclosures

NO SUSTAINABLE INVESTMENT OBJECTIVE

This financial product promotes environmental or social characteristics, but does not have as its objective sustainable investment.

ENVIRONMENT OR SOCIAL CHARACTERISTICS OF THE FINANCIAL PRODUCT

When determining what investments to make for the Sub-Fund, as part of the Investment Managers’ Sustainable Investment Policy, the Investment Manager considers environmental and social factors (at industry or company specific level), in the assessment of the strength of individual businesses and the risks associated with them. In respect of the environmental factors the Investment Manager takes into consideration, these include for example, assessing through its own due diligence and external third-party data, a company’s policies towards managing emissions, energy usage and waste management. In respect of the social factors the Investment Manager takes into consideration, these include for example focus that a company has on talent management and retention of employees and policies surrounding health, and safety and working practices.

In addition to the foregoing part of the investment process for the Sub-Fund, the Investment Manager also applies active exclusionary screening in the investment process to reduce Sustainability Risks. As part of the process the Investment Manager excludes from investment in the Sub-Fund companies that fall within certain listed categories (set out in further detail below).

As part of the Investment Manager’s Sustainable Investment Policy and investment process, the Investment Manager takes principal adverse impacts (”PAI”) on sustainability factors into account in its investment decision making process.

A reference benchmark has not been designated for the purpose of attaining the environmental or social characteristics promoted by the financial product.

INVESTMENT STRATEGY

The Investment Manager’s Sustainable Investment Policy consists of a multistage approach to integrating ESG factors and Sustainability Risks in investment decisions. The Investment Manager focuses on governance factors. The particular focus relates to two key elements of the Investment Manager’s investment philosophy, namely:

- investing in businesses where the shareholders’ interests are aligned with the company’s management; and

- where the company’s management has a track record of good capital allocation decisions, which have created long term value for all shareholders.

When determining what investments to make for the Sub-Fund, as part of the Investment Managers’ Sustainable Investment Policy, the Investment Manager considers environmental and social factors (at industry or company specific level), in the assessment of the strength of individual businesses and the risks associated with them. In respect of the environmental factors the Investment Manager takes into consideration, these include for example, assessing through its own due diligence and external third-party data, a company’s policies towards managing emissions, energy usage and waste management. In respect of the social factors the Investment Manager takes into consideration, these include for example a focus that a company has on talent management and retention of employees and policies surrounding health, and safety and working practices.

The Investment Manager uses a number of resources to deepen its knowledge of business and governance practices at investee companies. To supplement its own due diligence efforts, the Investment Manager utilises resources, such as proxy voting services, external sustainability research and engagement groups through the UN PRI and/or Climate Action 100+. Internal due diligence includes writing to management teams to source additional information. The Investment Manager’s due diligence of a company’s ESG policies will place the company into the context of global best-practice and assess the potential materiality of the risk associated with these policies to the company’s earnings.

The Investment Manager believes that dialogue with investee companies as well as proxy voting are ways to add value to the investment process and that stronger ESG practices will be reflected in better company and stock performance. Through constructive engagement with company management, from a medium term to long-term perspective, the Investment Manager seeks to help promote an investee company’s sustainable growth. Additionally, the Investment Manager seeks to enhance ESG practices at investee companies through proxy voting. The Investment Manager views this direct engagement with investee companies as an essential part of the investment process.

The Investment Manager applies its own proprietary systems and research, aiming to develop an accurate understanding and assessment of a portfolio company’s ESG practices. While the Investment Manager uses Refinitiv’s Asset4 and MSCI ESG external research data as its principal providers for ESG metrics, the Investment Manager also conducts its own proprietary research to arrive at independent ratings. This proprietary analysis aims to supplement the gaps in data, to address some the material pitfalls of vendor data, notably placing greater overall emphasis on corporate governance and remove exclusive reliance on a third-party vendor. In addition, where gaps exist in company disclosures, the Investment Manager actively engages with the company to improve transparency.

Based on the Investment Manager’s qualitative assessment of a company’s practices within the context of global best practices, disclosures and goal setting, and any third-party data that is available, on completion of the review, the Investment Manager assigns a rating of ”A”, ”B”, ”C” or ”D”, (i) ”A” being high quality practices, (ii) ”B” being moderate quality practices, (iii) ”C” being low quality practices; or (iv) ”D” whereby a review by the Investment Manager’s analyst team will be requested. Where a ”D” rating is assigned to a company, the company will be excluded by the Investment Manager from investment in the Sub-Fund. Within the overall assessment the Investment Manager also indicates a qualitative assessment of the company’s risk as it relates to Sustainability Risks, accounting, litigation any other relevant risk that may potentially impair earnings. The Investment Manager will also indicate if there is an opportunity for the analysts to engage with the company.

In addition to the foregoing part of the investment process for the Sub-Fund, the Investment Manager also applies exclusionary screening. As part of the process the Investment Manager excludes from investment in the Sub-Fund companies that fall within any of the following categories: (i) are involved in the production or trade in weapons and munitions*[1], (ii) are involved in the production of tobacco*, (iii) are involved in gambling, casinos and equivalent enterprises*, (iv) are involved in the production of thermal coal, (v) are involved in the production of oil from oil sands, (vi) are involved in adult entertainment enterprises; and (vii) are rated ”D” by the Chief Sustainability Officer.

[1] *This does not apply to project sponsors who are not substantially involved in these activities. “Not substantially involved” means that the activity concerned is ancillary to a project sponsor’s primary operations and comprises less than 5% of total annual revenue.

As a signatory to the Climate Action 100+ initiative the Investment Manager is committed to collectively engaging companies to (i) curb emissions, (ii) improve governance; and (iii) strengthen climate-related financial disclosures. The Investment Manager believes that improving company governance, curbing emissions and strengthening disclosures increases the risk-adjusted return potential, whilst also serving to help tackle the systemic risk that climate change represents.

In connection with adhering to the UN PRI, the Investment Manager is committed to the following six principles (the ”UN PRI Principles”):

- to incorporate ESG issues into investment analysis and decision-making processes;

- to be an active owner and to incorporate ESG factors into its ownership policies and practices;

- to seek appropriate disclosure on ESG factors by the entities in which it invests in;

- to promote acceptance and implementation of the UN PRI Principles within the investment industry;

- to work with the PRI Secretariat and other signatories to enhance their effectiveness in implementing the UN PRI Principles; and

- to report on our activities and progress towards implementing the UN PRI Principles.

PROPORTION OF INVESTMENTS

The Sub-Fund aims to hold a minimum of 50% of investments of the Sub-Fund’s portfolio that are aligned with the environmental or social characteristics promoted by the Sub-Fund. The Sub-Fund does not commit to holding sustainable investments. The Sub-Fund will not hold more than 50% of investments that are not aligned with the environmental or social characteristics promoted by the Sub-Fund and are not sustainable investments, and which fall into the “Other” section of the Sub-Fund (further details of which are set out below).

The Sub-Fund follows a long/short strategy where gross leverage is limited to 200% of NAV but is expected to average below this. In regards to the gross exposure of the Sub-Fund, it is expected that 50% of holdings will be aligned with environmental or social characteristics promoted by the Sub-Fund. It is expected that 70% of the long side of the Sub-Fund’s portfolio will be aligned with environmental or social characteristics promoted by the Sub-Fund. Short positions are not subjected to ESG related due diligence and would therefore fall under #2 Other along with positions such as closed-end fund investments which are not reviewed as the Investment Manager cannot control the external manager’s process and implementation.

The Investment Manager’s Sustainable Investment Policy particularly applies to the long side of the Sub-Fund which takes a 3 to 7 year time horizon. The Investment Manager’s short positions are short-term (typically within twelve to eighteen months) and more tactical therefore may or may not take ESG factors into consideration which are long term by nature.

Please note that while the Sub-Fund aims to achieve the asset allocation targets outlined above, these figures may fluctuate during the investment period and ultimately, as with any investment target, may not be attained. The exact asset allocation of the Sub-Fund will be reported in the Sub-Fund’s periodic report for the relevant reference period.

MONITORING OF ENVIRONMENTAL OR SOCIAL CHARACTERISTICS

The Investment Manager will assess and track the performance of companies with regards to environmental and/or social characteristics promoted by the Sub-Fund using a number of the sustainability indicators as detailed below, including companies that (i) hold ISO 14001 (or equivalent) and/or ISO 50001 (or equivalent) certifications, (ii) are members of the UN Global Compact and have adopted UN Sustainable Development Goals in their long-term planning, (iii) are aligned with the Paris Agreement and those that are EU Taxonomy aligned, (iv) hold OHAS 18001/45001 (or equivalent), ISO 27001 (IT security), and/or ISO 9001 (quality management) certifications; and (v) have publicly documented human rights policies, ethics and corruption policies and sufficient whistleblower protections in place (as further detailed below). The sustainability indicators will be used to measure the attainment of the environmental and social characteristics promoted by the Sub-Fund.

METHODOLOGIES OF ENVIRONMENTAL OR SOCIAL CHARACTERISTICS

As part of the investment process, the Investment Manager considers a variety of indicators to measure the environmental and/or social characteristics promoted by the Sub-Fund. The Investment Manager monitors energy management, emissions and waste management by identifying the companies that hold ISO 14001 (or equivalent) and/or ISO 50001 (or equivalent) certifications. The Investment Manager tracks how many companies are members of the UN Global Compact and have adopted UN Sustainable Development Goals in their long-term planning. The Investment Manager also monitors the number of companies that have aligned with the Paris Agreement and those that are EU Taxonomy aligned. Finally, where data is available (and relevant), the Investment Manager will assess long-term Scope 1, 2 and 3 emissions performance.

For the purposes of assessing social characteristics, the Investment Manager identifies those companies that hold OHAS 18001/45001 (or equivalent) (occupational health and safety management), ISO 27001 (IT security), and/or ISO 9001 (quality management) certifications. The Investment Manager also identifies those companies that have publicly documented human rights policies, ethics and corruption policies and sufficient whistleblower protections in place.

DATA SOURCES AND PROCESSING

The Investment Manager uses a range of data providers when assessing a portfolio company’s ESG practices, in addition to its own proprietary analysis and research. The primary third party data providers are Refinitiv and MSCI, in addition to Bloomberg.

As noted above, in addition to utilising third party data providers, the Investment Manager also conducts its own proprietary research to arrive at independent ratings. This proprietary analysis aims to supplement the gaps in data, to address some the material pitfalls of vendor data, notably placing greater overall emphasis on corporate governance and remove exclusive reliance on a third-party vendor. Where gaps exist in company disclosures, the Investment Manager actively engages with the company to improve transparency.

The Investment Manager will also utilise third-party data, namely Refinitiv and Bloomberg, when considering PAI on sustainability factors in its investment decision making process.

LIMITATIONS TO METHODOLOGIES AND DATA

While data sets across Asian markets are currently limited, the Investment Manager’s expectation is that data coverage will continue to expand over time as more markets introduce climate related reporting regimes to comply with the Paris Agreement. Third party vendors provide high quality research, however the Investment Manager recognises the limitations in external ESG methodologies and does not rely on it exclusively. The Investment Manager is satisfied such limitations do not affect how the environmental or social characteristics promoted by the Sub-Fund are met due to the processes it has implemented to mitigate such limitations as the Investment Manager has developed its own proprietary ESG investment process and the Investment Manager will assess third party vendors research as part of its ongoing due diligence.

DUE DILIGENCE

In respect of due diligence, as part of the Investment Managers’ Sustainable Investment Policy, as outlined above, when determining the environmental factors the Investment Manager takes into consideration, these include for example, assessing through its own due diligence and external third-party data, a company’s policies towards managing emissions, energy usage and waste management.

Furthermore, as outlined above, the Investment Manager uses a number of resources to deepen its knowledge of business and governance practices at investee companies. To supplement its own due diligence efforts, the Investment Manager utilises resources, such as proxy voting services, external sustainability research and engagement groups through the UN PRI and/or Climate Action 100+. Internal due diligence includes writing to management teams to source additional information. The Investment Manager’s due diligence of a company’s ESG policies will place the company into the context of global best-practice and assess the potential materiality of the risk associated with these policies to the company’s earnings.

ENGAGEMENT POLICIES

The Investment Manger views engagement with investee companies as an essential part of the investment process. Where the Sub-Fund has invested in a company and the Investment Manager has developed a relationship with the management team of that company, the Investment Manager will engage with companies seeking to promote positive change on ESG matters.

The Investment Manager believes that dialogue with investee companies as well as proxy voting are ways to add value to the investment process and that stronger ESG practices will be reflected in better company and stock performance. Through constructive engagement with company management, from a medium term to long-term perspective, the Investment Manager seeks to help promote an investee company’s sustainable growth. Additionally, the Investment Manager seeks to enhance ESG practices at investee companies through proxy voting.

DESIGNATED REFERENCE BENCHMARK

A reference benchmark has not been designated for the purpose of attaining the environmental or social characteristics promoted by the financial product.

PRINCIPAL ADVERSE IMPACTS STATEMENT

Since the adoption of Article 8 status of the Fund, the investment manager has been considering the Principal Adverse Impact (“PAI”) framework set out within the Regulatory Technical Standards (“RTS”) applicable under the EU Sustainable Finance Disclosure Regulation (SFDR). In 2023, the manager completed an extensive exercise to develop the systems and data tools to ensure it was sufficiently equipped to provide reporting around the mandatory PAI indicators and two additional voluntary indicators as required. The investment manager has leveraged data sets available through its primary data provider Refinitiv and utilises additional data from Bloomberg. For complete information on the data sets used and the methodology of our RTS process please refer to the investment manager’s sustainability policy. The investment manager will report the PAI indicators as part of its ongoing quarterly reporting package and will utilise data as an additional engagement tool when providing constructive engagement to company management and boards. In addition, where relevant it will use the data to inform voting around environmental issues.

REMUNERATION POLICY

ALIGNMENT OF INTEREST

There is a high degree of alignment of interests between employees and clients at Dalton which is achieved through high levels of employee equity ownership and remuneration linked to client outcomes. Indeed, a high level of alignment between employees and clients is a cultural aspect of the organization itself.

EQUITY OWNERSHIP

Dalton is entirely employee-owned, with no intention of changing this structure. The majority owner and CIO views it as essential that senior members of the investment team are themselves “owner-operators”, much like the companies Dalton invests in. Equity in Dalton is gradually being sold by 3 of Dalton’s 4 founding partners to the next generation (CIO retaining majority). Employees are invited to participate in these purchases as a recognition of their performance and importance to the future of Dalton. Recommendations on which employees to invite are made by the Management Committee and signed-off by Dalton’s majority owner annually. As of June 2023, 13 employees have become new partners of the firm (17 partners total when you include the 4 founders).

REMUNERATION

Recommendations on compensation for Dalton team members are proposed by the Management Committee and ultimately signed off by the majority shareholder and CIO.

Dalton’s primary driver of profitability is providing clients with attractive risk-adjusted returns and superior client servicing and retention. In this manner, Dalton believes that discretionary bonuses help to align the interest of employees and clients.

At Dalton, fixed salaries are kept at a moderate level (Dalton uses an external compensation benchmarking service to ensure fairness), while bonus payments reflect an individual’s contribution to the business over the long-term.

While evaluating the Analyst Team, the Management Committee takes into account an analyst’s research efforts and contribution to overall firm profitability. Bonus are based upon 1) the profitability of Dalton, 2) performance of the investment funds they are managing, and 3) contribution to the overall firm. Team members are assessed on various hard metrics, such as absolute and relative returns over 1-year and 5-year periods, as well as soft metrics (team collaboration/communication, engagement activities, marketing contribution, commitment to ESG and adherence to the investment philosophy).

Dalton expects its investment team to reinvest 50% of their bonus into Dalton’s funds with an objective of having 3 to 5 times their annual salaries aligned with clients through their fund investments.

Long-term successful employees can buy into or further increase their share in Dalton. Dalton believes this system aligns investment team members with its clients and locks them into the firm for the long term.

CO-INVESTMENT

Considering Dalton’s expectation on bonus reinvestment, the investment team members have the majority of their net worth invested in Dalton’s portfolio stocks. As at end-June 2023, Dalton team members had $64m invested in Dalton funds.